How to Win The Race

to Create $3,000 in

Monthly Retirement IncomE

There aren’t many guarantees in life and retirement income has always been one of the least guaranteed for almost all of us!

Life’s unknowns serve as a significant source of anxiety and the unknowns and falsehoods surrounding retirement planning can be the worst! A 2015 study conducted by WealthVest found 77% of Americans over 45 are less comfortable with investment risk than they were a decade ago.

How do you feel about having your hard earned money at risk of loss?

Life’s unknowns serve as a significant source of anxiety and the unknowns and falsehoods surrounding retirement planning can be the worst! A 2015 study conducted by WealthVest found 77% of Americans over 45 are less comfortable with investment risk than they were a decade ago.

How do you feel about having your hard earned money at risk of loss?

Monthly Guaranteed Income is the Top Trait Boomers Say They Look for in a Retirement Investment.

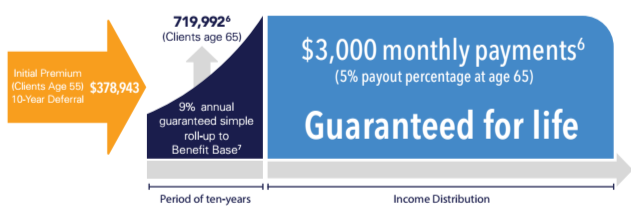

A Strategy for Americans Looking to Create $3,000 in Monthly Guaranteed Income in Ten Years…

Here we’re assuming our Hypothetical American is age 55 looking to begin guaranteed monthly income payments of $3,000 in ten years using a lifetime rider.

The hypothetical lifetime income rider has a guaranteed roll-up rate to the benefit base of 9% simple interest and a payout percentage of 5% at age 65.

Let’s take a look at the initial premium required to generate $3,000 in guaranteed monthly income ten years from now.

Here we’re assuming our Hypothetical American is age 55 looking to begin guaranteed monthly income payments of $3,000 in ten years using a lifetime rider.

The hypothetical lifetime income rider has a guaranteed roll-up rate to the benefit base of 9% simple interest and a payout percentage of 5% at age 65.

Let’s take a look at the initial premium required to generate $3,000 in guaranteed monthly income ten years from now.

At age 55 you'd need $378,943 of YOUR money to create a $3,000 per month Guaranteed for Life.

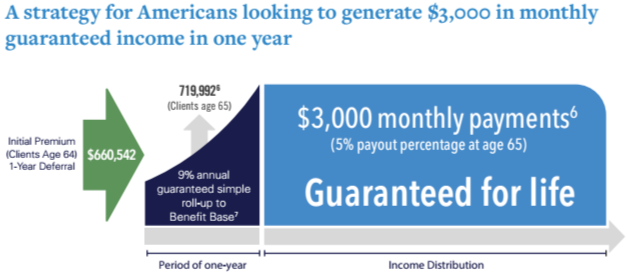

Compared with a Strategy for Americans Looking to Create $3,000 in Monthly Guaranteed Income Starting in ONE YEAR…

Assume you’re looking at a hypothetical American assuming age 64 who wants to begin guaranteed monthly income payments of $3,000 in one year using a lifetime rider.

Our hypothetical lifetime income rider has a guaranteed roll-up rate to the benefit base of 9% simple interest and a payout percentage of 5% at age 65.

The initial premium required to generate $3,000 in monthly guaranteed income after one-year of deferral is $660,542.

Assume you’re looking at a hypothetical American assuming age 64 who wants to begin guaranteed monthly income payments of $3,000 in one year using a lifetime rider.

Our hypothetical lifetime income rider has a guaranteed roll-up rate to the benefit base of 9% simple interest and a payout percentage of 5% at age 65.

The initial premium required to generate $3,000 in monthly guaranteed income after one-year of deferral is $660,542.

At age 64, you'd need $660,542 of Your Own Money to Create $3,000 a month income Guaranteed for Life!

Both strategies explained above end in $3,000 monthly income payments which are guaranteed* to last a lifetime. The only difference is the initial premium required and the number of years you wait until taking income.

*Guarantees are backed by the financial strength of the highly rated Life Insurance Companies making them.

In this example we focus on the benefits associated with the lifetime income rider available on many fixed index annuities. There are additional benefits associated with fixed index annuities not included in this example that you may want to discuss with us.

Analyzing this a little further, if you assume you have $378,943 now, what would that investment have to earn to have the $660,542 you'd need in 9 years to achieve the same outcome in the first hypothetical scenario?

It would require an actual return, a Compounded Average Growth Rate (CAGR) of 6.37% after fees over that 9 year period.

Did you know…most of the time the “average returns” the market quotes are not “Actual Returns” or CAGR, they are average returns. Actual returns are typically considerably lower than quoted Average Returns.

Would you prefer the Guarantee you’ll have that income in ten years or hope the market will perform well enough to do that for you?

Which is better for you CERTAINTY or UNCERTAINTY?

Here's a great question...Does it pay to plan ahead?

*Guarantees are backed by the financial strength of the highly rated Life Insurance Companies making them.

In this example we focus on the benefits associated with the lifetime income rider available on many fixed index annuities. There are additional benefits associated with fixed index annuities not included in this example that you may want to discuss with us.

Analyzing this a little further, if you assume you have $378,943 now, what would that investment have to earn to have the $660,542 you'd need in 9 years to achieve the same outcome in the first hypothetical scenario?

It would require an actual return, a Compounded Average Growth Rate (CAGR) of 6.37% after fees over that 9 year period.

Did you know…most of the time the “average returns” the market quotes are not “Actual Returns” or CAGR, they are average returns. Actual returns are typically considerably lower than quoted Average Returns.

Would you prefer the Guarantee you’ll have that income in ten years or hope the market will perform well enough to do that for you?

Which is better for you CERTAINTY or UNCERTAINTY?

Here's a great question...Does it pay to plan ahead?

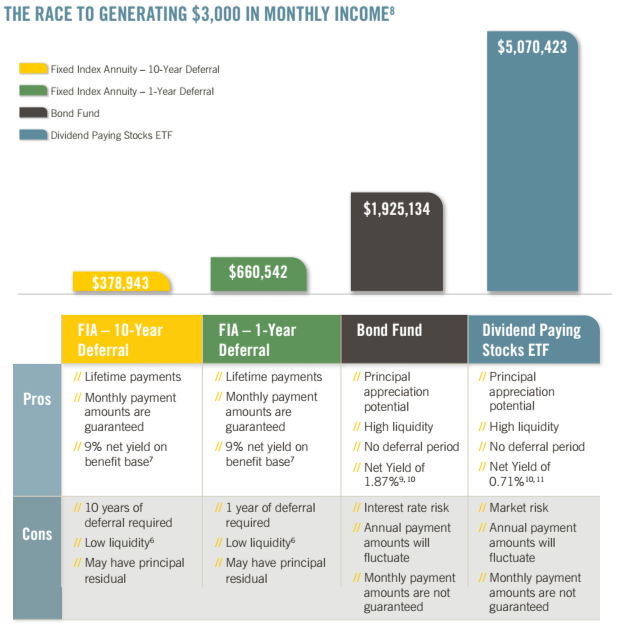

Comparing Income Strategies

There are a number of investment strategies which can generate monthly income payments during retirement. It is important to understand the options and trust that your financial pro is helping you find the best strategies for you, your spouse and your heirs. Traditionally, these strategies can be broken down into three basic categories:

Dividend-Paying Stocks or Bonds and Bond Funds or Annuities Using Lifetime Income Riders

The Race to Create $3,000 in Monthly Income

There are a number of investment strategies which can generate monthly income payments during retirement. It is important to understand the options and trust that your financial pro is helping you find the best strategies for you, your spouse and your heirs. Traditionally, these strategies can be broken down into three basic categories:

Dividend-Paying Stocks or Bonds and Bond Funds or Annuities Using Lifetime Income Riders

The Race to Create $3,000 in Monthly Income

The graph below, assumes a hypothetical American age 65 creating $3,000 a month income, that is NOT Guaranteed either in a Bond Fund or a Dividend Paying Stocks ETF.

The Bond Fund requires $1,925,134 of YOUR Money to create that $3,000 a month income. Bond Funds are also at risk of losing or gaining value depending upon interest rates.

The Dividend Paying Stocks ETF requires $5,070,423 of YOUR Money to create $3,000 a month income...if the dividends don't go down...but they could also go up.

The Bond Fund requires $1,925,134 of YOUR Money to create that $3,000 a month income. Bond Funds are also at risk of losing or gaining value depending upon interest rates.

The Dividend Paying Stocks ETF requires $5,070,423 of YOUR Money to create $3,000 a month income...if the dividends don't go down...but they could also go up.

Which amount of YOUR MONEY would you want funding your retirement income?

- Plan ahead 10 years and need $378,943 of your money?

- Plan ahead 1 year and need $660,542 of your money? You'd have needed your $378,943 to earn an ACTUAL 6.37% return after fees...depending on how volatile the market was over that 9 years and the amount of the fees paid, you could have needed a 9%, 10%, 11% gross market return. Is that something you want to count on to fund your retirement?

- Need $1,925,134 of your money at the time of retirement...which means your $378,943 would have needed to earn an ACTUAL RETURN net after fees of 17.65% over that 10 year period before retirement! Do you seriously think the market would return anywhere near that much over 10 years?

- Need $5,070,423 of your money at the time of retirement...which means your $378,943 would have had to earn an actual return after fees of 29.61% over that 10 year period before retirement. Isn't this a ridiculous actual return to expect to have over any time period?

I'll add another popular option to this analysis.

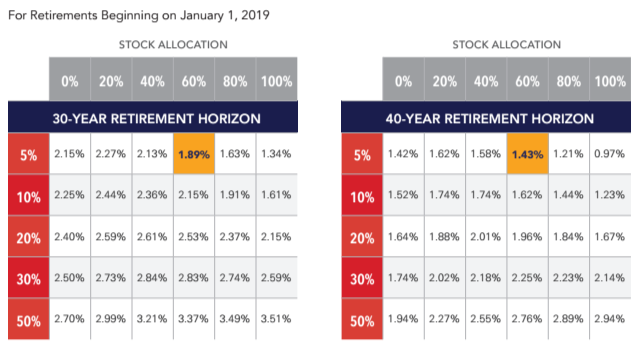

Many Advisors, who follow Traditional Retirement Planning, recommend a 60/40 stock to bond mix to create an income you have a good chance to not outlive. No guarantees and totally dependent upon market performance.

Do you want to live your retirement years with a plan that has a good chance you won't outlive your money or would you want more certainty with guarantees?

Retirement scholar Wade Pfau from the American College of Retirement has studies that show for a 30 year retirement horizon with a 5% chance of not outliving your money your safe withdrawal rate is 1.89% and it is 1.43% if you look at a 40 year retirement horizon. (Shown below)

Many Advisors, who follow Traditional Retirement Planning, recommend a 60/40 stock to bond mix to create an income you have a good chance to not outlive. No guarantees and totally dependent upon market performance.

Do you want to live your retirement years with a plan that has a good chance you won't outlive your money or would you want more certainty with guarantees?

Retirement scholar Wade Pfau from the American College of Retirement has studies that show for a 30 year retirement horizon with a 5% chance of not outliving your money your safe withdrawal rate is 1.89% and it is 1.43% if you look at a 40 year retirement horizon. (Shown below)

Assuming the 1.89% safe withdrawal rate on a 30 year retirement horizon (highlighted above), to create $3,000 a month ($36,000 per year) you'd need $1,904,762 of your own money at the time of retirement which would require an after fees actual return of 17.52% return on your $378,943 over those 10 years before retirement.

Assuming that 1.43% safe withdrawal rate on a 40 year retirement horizon you'd need $2,517,483 of your own money at the time of retirement, which would mean your $378,943 would need to earn an after fees actual return of 20.85%.

What do you think the chances are of earning astronomical actual rates of return you'd need over those last 10 years before retirement?

Which of these options would YOU want to have creating the income you need to live on in retirement?

Would you also want the most efficient way to create the most lifelong income to also create the money you need to play in retirement? Kind of a pay check and a play check, right?

Would you like to see what an Efficient, Certain, Lifelong Income Plan would look like for you?

When you're ready either call Kurt Jackson on his direct line at 816.582.5532 or complete the form below and we'll reach out to you to set up a time to talk.

A little FYI, the longer you wait, the MORE of YOUR MONEY you'll need to get the lifelong retirement income you desire!!!

Assuming that 1.43% safe withdrawal rate on a 40 year retirement horizon you'd need $2,517,483 of your own money at the time of retirement, which would mean your $378,943 would need to earn an after fees actual return of 20.85%.

What do you think the chances are of earning astronomical actual rates of return you'd need over those last 10 years before retirement?

Which of these options would YOU want to have creating the income you need to live on in retirement?

Would you also want the most efficient way to create the most lifelong income to also create the money you need to play in retirement? Kind of a pay check and a play check, right?

Would you like to see what an Efficient, Certain, Lifelong Income Plan would look like for you?

When you're ready either call Kurt Jackson on his direct line at 816.582.5532 or complete the form below and we'll reach out to you to set up a time to talk.

A little FYI, the longer you wait, the MORE of YOUR MONEY you'll need to get the lifelong retirement income you desire!!!