Do You Have Too Much Risk In your Retirement Portfolio?

The recent market crash thanks to the reaction to the Coronavirus dropped the market more than 30% and has people asking themselves...Am I taking too much risk in my retirement portfolio?

We can help you find the answer to your unique situation AND even provide the tool to see if you are taking too much risk or not!

Start by finding your Personal Risk Score...

We can help you find the answer to your unique situation AND even provide the tool to see if you are taking too much risk or not!

Start by finding your Personal Risk Score...

Find Your Personal Risk Score

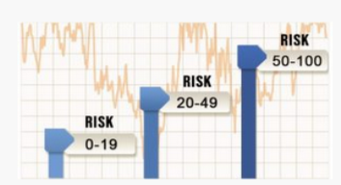

Most people have no idea what their true appetite for "risk" is when it comes to growing wealth for retirement. We use the industry's most accurate risk assessment software to help clients determine their Personal Risk Score. If you want to know your Risk Score on a scale from 1-100, click on the button below!

Do you WOnder how risky your investments are?

Find out by using our Investment Risk Quick Score App!