Which Retirement Income Would You Want?

Creating income in retirement is one of the most important and most challenging things we must plan for.

When we envision our retirement don’t we all pretty much strive for a Comfortable Retirement Lifestyle for as long as we live?

When you think about it, isn’t the big challenge not knowing how long you’re going to live and if you have a spouse there are two lives to contend with?

When it comes time to plan for retirement income, too many folks opt for the traditional method of withdrawing a percentage of their portfolio and adjusting it higher for inflation to have a good chance of not outliving their money.

Sound familiar?

When we envision our retirement don’t we all pretty much strive for a Comfortable Retirement Lifestyle for as long as we live?

When you think about it, isn’t the big challenge not knowing how long you’re going to live and if you have a spouse there are two lives to contend with?

When it comes time to plan for retirement income, too many folks opt for the traditional method of withdrawing a percentage of their portfolio and adjusting it higher for inflation to have a good chance of not outliving their money.

Sound familiar?

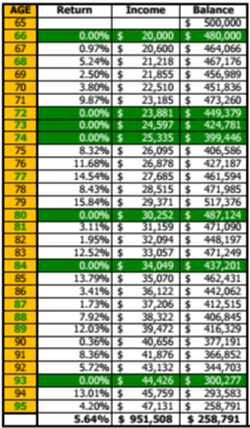

Hypothetical example...Creating Retirement Income for one person or two, using actual market returns from the S&P 500 without dividends.

Assuming age 65, living a 30 year retirement, $500,000 retirement portfolio, a 4% withdrawal rate and 3% annual inflation (which boosts income 3% per year to keep up with inflation)!

Assuming age 65, living a 30 year retirement, $500,000 retirement portfolio, a 4% withdrawal rate and 3% annual inflation (which boosts income 3% per year to keep up with inflation)!

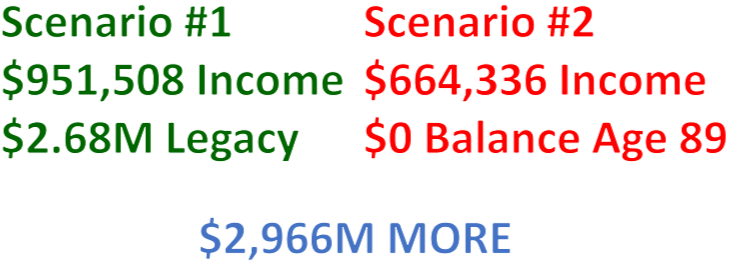

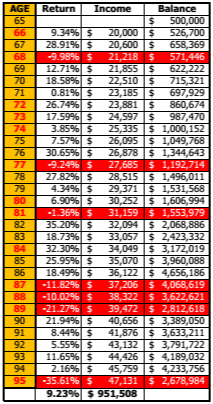

Scenario #1:

- Assuming a very positive market scenario with an average annual return of 9.23%

- Income begins at $20,000 growing at a 3% rate ends with $47,131 at the age of 95

- Total income paid out of $951,508

- Ending balance to be transferred to your heirs $2,678,984

- Obviously a great scenario and what we all hope happens to our retirement, but there are no guarantees this is how it would go.

- What happens if the market doesn't go this particular way?

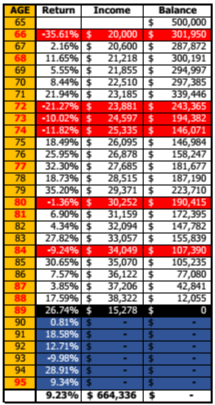

Scenario #2:

- Assuming the same 9.23% average annual return, but with a different sequence of annual returns. (Sequence of Return Risk) All we did was flip the sequence of returns. Do you know for sure you'll get the more positive sequence of returns?

- Notice the big loss in the first year? This can destroy a retirement. The biggest risks to retirement are losses in the 5 to 10 years before you retire and the 5 years after you retire.

- Income begins at $20,000 growing at a 3% rate...runs out of money at age 89 paying out a total of $664,336 income a whopping $287,172 less than Scenario #1.

- A total of $2,966,156 less than Scenario #1, since no money is left to your heirs.

- Nobody has control over what sequence these returns will occur.

- Even though the Average Annual Return was the same, the ACTUAL Return was considerably lower...thanks to the power of losses!

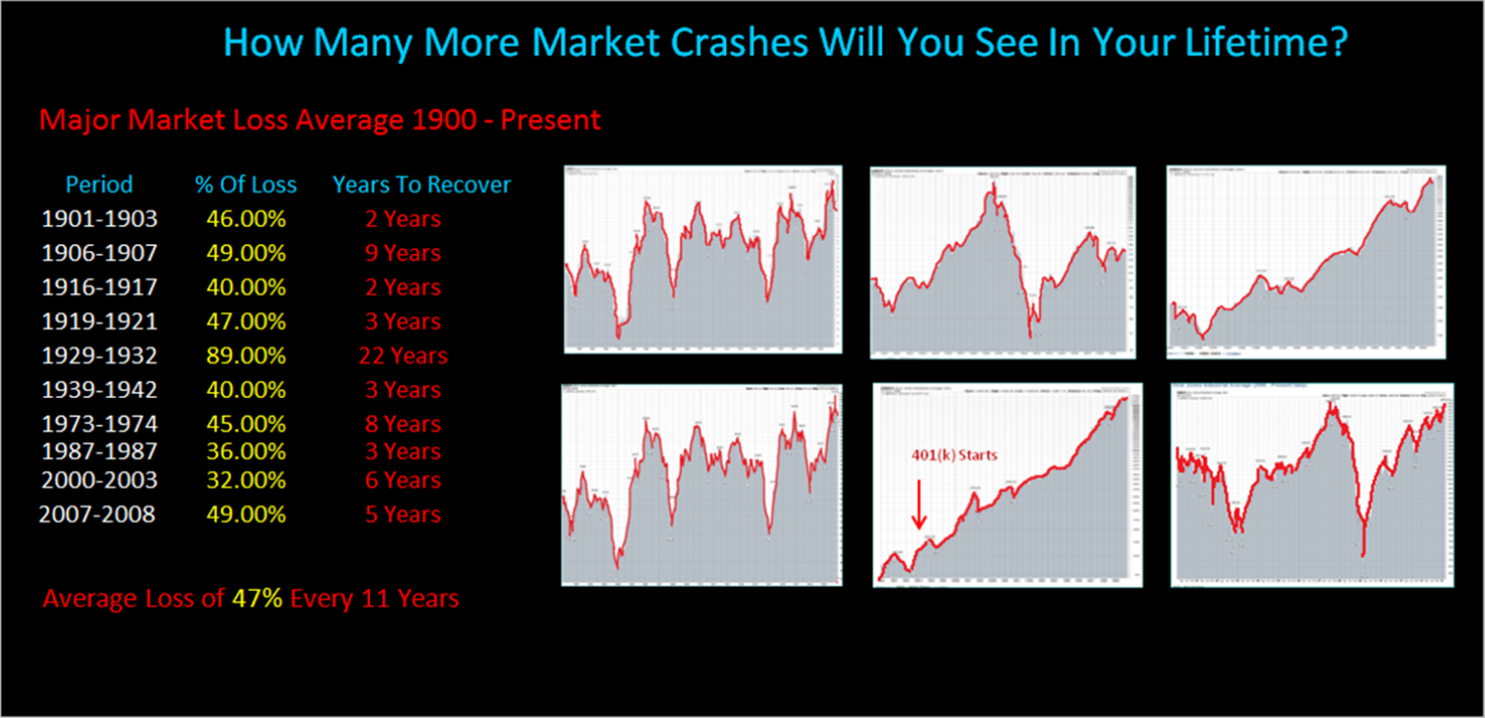

What is the risk you'd face of potential market risks?

Since 1900 we've averaged a 47% loss every 11 years...what does that tell you?

Since 1900 we've averaged a 47% loss every 11 years...what does that tell you?

Could a 5.02% Average Annual Return ever be better than a 9.23% Average Annual Return?

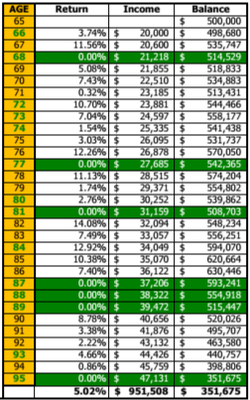

Scenario #3:

- Using the same more positive sequence of returns as Scenario #1.

- This financial vehicle protects against market losses, but the trade-off for that protection is it credits 40% of the market's upside and locks it in annually. We call this a Participation Rate.

- The Average Annual Return is 5.02%...remember it was 9.23% in Scenario #1 and #2 which gave us two totally different outcomes.

- In this very positive market situation this delivers the same $951,508 of income over 30 years as in Scenario #1.

- This also provides $351,675 in wealth transfer to your heirs.

- Granted, this doesn't provide the same tremendous wealth transfer in Scenario #1, but with the downside protection do you think it helps in a more negative Sequence of Returns like we saw in Scenario #2?

Scenario #4:

- Using the same negative Sequence of Returns as in Scenario #2.

- Using the same 40% Participation Rate as in Scenario #3

- You don't run out of money at age 89 as you did in Scenario #2.

- You get the full $951,508 lifetime retirement income.

- While smaller, there still is $85,463 in wealth transfer to your heirs!

- In our worse case scenario this allowed you to live your retirement without the worry of running out of money.

- This is one way you can battle the Sequence of Return Risk most traditional retirement income plans fail to accomplish.

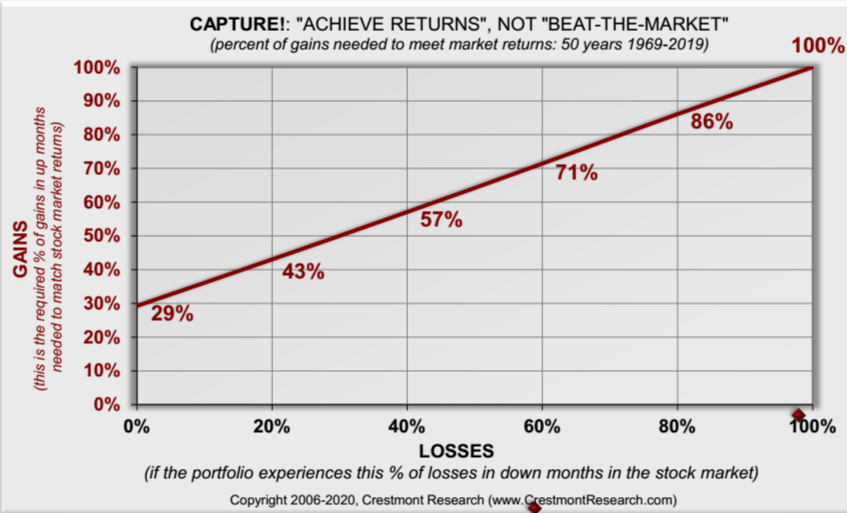

Crestmont Research conducts a rolling study on the past 50 years of market performance and as of the end of 2019 it found if you can eliminate losses you only need to capture 29% of the market's upside to meet the market.

Could that mean if you captured more than 29% you may have more money to work with?

Remember in Scenarios #3 and #4 we were capturing 40% of the market's upside which was an after fees amount.

Could that mean if you captured more than 29% you may have more money to work with?

Remember in Scenarios #3 and #4 we were capturing 40% of the market's upside which was an after fees amount.

What if we could capture more of the market?

Recently we've seen Participation Rates as high as 45%.

What would that do to our hypothetical scenarios?

Recently we've seen Participation Rates as high as 45%.

What would that do to our hypothetical scenarios?

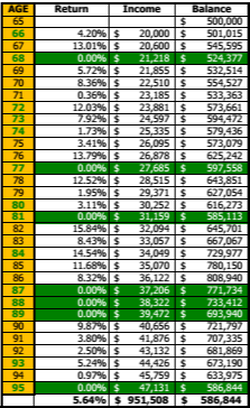

Scenario #5:

- Same returns as in Scenarios #1 and #3.

- Participation rate of 45% nets a 5.64% Average Annual Return

- Creates $951,508 in total 30 year retirement income.

- While leaving $586,844 in legacy funds for your loved ones.

- Still not the same amount of legacy funds as in Scenario #1...isn't it a big gamble to think you could get those great results in Scenario #1?

- Are you trying to die rich or live comfortably in retirement?

- Doesn't this scenario let you live comfortably and die semi-rich?

Scenario #6:

- Here we're using the more negative Sequence of Returns like Scenario #2 & #4

- The 45% Participation rate still delivers a 5.64% Average Annual Return

- You still receive the 30 full years of income $951,508.

- AND you have $258,791 of legacy to leave to your loved ones.

- Would this type of retirement income plan give you the confidence to live your retirement worry free about money?

These aren't the only Retirement Income Strategies available to you, we have access to many others and they can be designed to fit your needs.

Our hope with this particular information is that you realize how risky it can be to rely on traditional market based retirement income plans that so many Traditional Advisors seem to utilize.

We feel there is no need to take the risk of ever running out of money by having your retirement income plan dependent upon having the right Sequence of Returns.

If you'd like to see what retirement income plans could look like for your particular situation please complete the form below and we'll get back to you right away.

Our hope with this particular information is that you realize how risky it can be to rely on traditional market based retirement income plans that so many Traditional Advisors seem to utilize.

We feel there is no need to take the risk of ever running out of money by having your retirement income plan dependent upon having the right Sequence of Returns.

If you'd like to see what retirement income plans could look like for your particular situation please complete the form below and we'll get back to you right away.